For instance, good student discounts are available with many insurance business (insurance). GEICO offers a discount rate for trainees with a B standard or higher, but each company has its very own standards, so it is crucial to consult your insurer to discover exactly what the demands are for this discount rate.

This discount could apply if you are going to college a minimum of 100 miles away from house and also leaving your cars and truck behind. insurance. If you take your cars and truck with you to institution, the price cut does not apply. Safe driving training courses can also gain a young grown-up or teen vehicle driver a discount rate on their insurance policy.

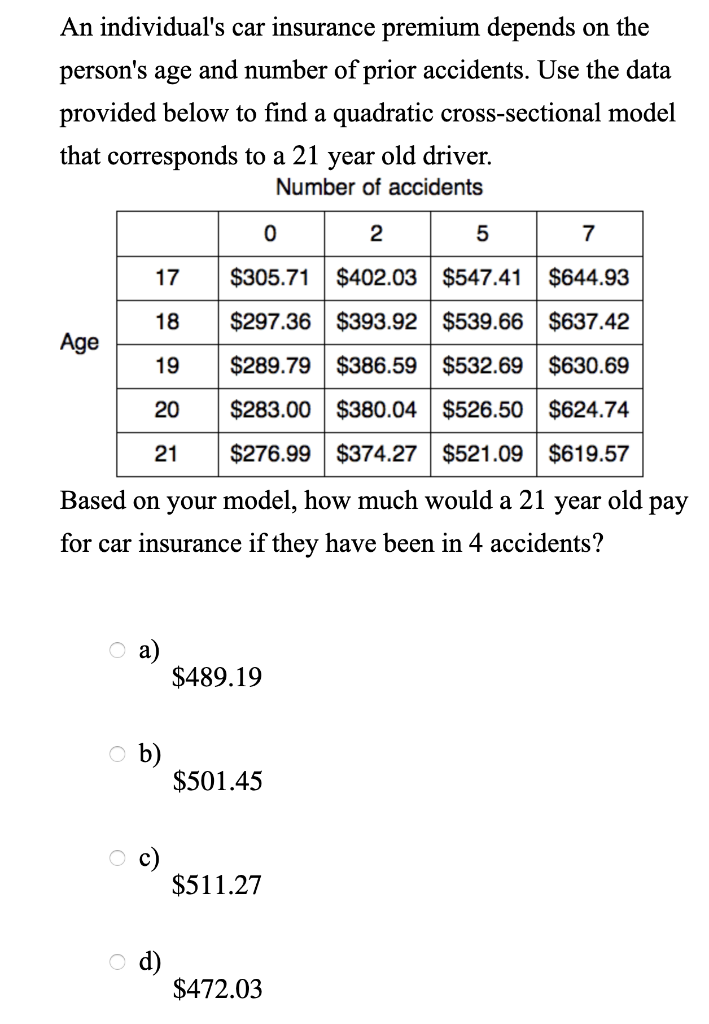

Why Is Automobile Insurance So Pricey for a 21-Year-Old? Car insurance coverage for 21-year-old drivers is costly due to the fact that insurance coverage business use your motoring history to help identify your insurance policy rates. With just a few years of driving experience, they automatically skip to an assumption that you will certainly submit a case. insured car. Insurance providers likewise research analytical groups, with years of documents indicating that teen and young grown-up chauffeurs are the most likely to be reckless behind the wheel.

You can see the info used to establish these averages on our technique and disclaimer web page. money. Learn more on Car Insurance, Automobile Insurance Policy, Car Insurance Coverage, Concerning the Writer.

The average price of auto insurance in the USA is $2,388 each year or $199 per month, according to data from almost 100,000 insurance policy holders from Savvy. The state you stay in, the degree of coverage you wish to have, and also your sex, age, credit rating, and also driving background will all variable into your premium - low cost.

Cars and truck insurance policy policies have great deals of moving components, as well as your premium, or the cost you'll spend for insurance coverage, is just among them. Insurance is managed at the state degree, and also regulations on required insurance coverage and pricing are different in every state. Insurance coverage companies think about various aspects, including the state and also area where you live, along with your gender, age, driving background, and the level of insurance coverage you would certainly like to have.

The Basic Principles Of In A Preliminary Report, Thp Said Sherri M. The Tennessee ...

Right here are the most significant aspects that will certainly affect the price you'll pay for insurance coverage, and also what to think about when looking at your cars and truck insurance alternatives. There have been some huge changes to car insurance expenses during the coronavirus pandemic.

Service Expert created a list of ordinary vehicle insurance coverage costs for every state. These prices were identified as a standard of rates reported by Nerdwallet, The Zebra, Value, Penguin, Bankrate, and the National Association of Insurance Policy Commissioners. Here's an array vehicle insurance policy costs by state. Resource: Data from Nerdwallet, Value, Penguin, Bankrate, The Zebra, as well as the National Association of Insurance Commissioners.

car insured cheapest cheapest insurers

car insured cheapest cheapest insurers

And Also from Service Insider's data, car insurance coverage firms have a tendency to charge women much more. Company Insider collected quotes from Allstate and State Farm for standard protection for male and also women chauffeurs with an identical account in Austin, Texas. When switching out just the sex, the male account was priced quote $1,069 for coverage each year, while the female account was priced quote $1,124 each year for protection, setting you back the woman chauffeur 5% even more.

In states where X is a sex option on chauffeur's licenses consisting of Oregon, California, Maine, and also quickly New York insurance providers are still figuring out just how to calculate prices. Typical car insurance premiums by age, The variety of years you have actually been driving will impact the price you'll spend for coverage. While an 18-year-old's insurance policy standards $2,667.

insure accident insured car low cost auto

insure accident insured car low cost auto

This data was offered to Business Expert by Savvy. Just how cars and truck insurance rates alter with the variety of vehicles you own, Somehow, it's logical: the a lot more automobiles you have on your policy, the higher your automobile insurance bills. There are also some financial savings when several cars are on one plan.

Car insurance is less costly in zip codes that are a lot more country, as well as the same is real at the state level. Other variables that can affect the cost of cars and truck insurance There are a few other factors that will contribute to your costs, consisting of: If you do not drive many miles per year, you're less likely to be involved in a mishap.

How Car Insurance For Young Drivers - Compare The Market can Save You Time, Stress, and Money.

Each insurance coverage company looks at all of these elements and prices your protection in different ways as a result. Obtain quotes from several different vehicle insurance policy firms as well as contrast them to make sure you're getting the best deal for you.

When it concerns teen chauffeurs and car insurance policy, points get complicated-- and pricey-- rapidly (suvs). A parent including a male teen to a policy can expect vehicle insurance rate to balloon to greater than $3,000 for full insurance coverage. It's even higher if the teen has his very own policy.

Now, that we've reviewed those serious facts, allow's guide you through your car insurance policy buying. We'll check out price cuts, choices and also special situations-- so you can locate the most effective auto insurance for teens - laws. Although the ideal solution is typically to add a teen onto your policy to mitigate several of the expense, there are other choices as well as discount rates that can save cash.

KEY TAKEAWAYSAccording to the government Centers for Illness Control and Avoidance, the worst age for crashes is 16. If the trainee intends to leave a car at home and the college is even more than 100 miles away, the college student can certify for a "resident trainee" discount rate or a trainee "away" discount rate.

IN THIS ARTICLEHow much is cars and truck insurance policy for teens? The more youthful the chauffeur, the much more pricey the vehicle insurance coverage. Youthful motorists are far much more likely to obtain right into automobile crashes than older motorists.

A research by the IIHS found states with more powerful graduated licensing programs had a 30% reduced deadly collision rate for 15- to 17-year olds. Including a young adult to your car insurance coverage, Including a teenager to your vehicle insurance coverage is the cheapest way to get your teenager guaranteed. It still comes with a large cost, yet you can definitely save if you select the most effective vehicle insurance coverage companies for teenagers. insurance.

Aa - Tá Na Mesa - Questions

vehicle insurance cheaper cars laws cheap car

vehicle insurance cheaper cars laws cheap car

After that we included a 16-year old teenager to the plan. Below's what took place: The typical household's auto insurance policy costs climbed 152%. An adolescent child was much more expensive. The typical expense increased 176%, contrasted with 129% for teen ladies. The golden state rates enhanced one of the most, even more than 200%. The factor behind the walkings: Teens accident at a much higher rate than older chauffeurs.

They have a crash rate two times as high as drivers that are 18- and also 19-year-olds. Costs differ by insurance coverage business, which is the reason we suggest shopping for teen chauffeur insurance coverage.

If my teen obtains a ticket, will it raise my rates?. As soon as together on the same policy, all driving documents-- including your teenager's-- affect costs, for far better or worse.

To understand just how a moving offense will certainly influence your rates, we ran a study and discovered that the additional expense might run from 5% to as high as 20%. Can a teen get their own cars and truck insurance plan? Firms will market directly to teens. State laws differ when it comes to a teenager's capacity to authorize for insurance coverage.

Your teen will likely have a higher costs contrasted to including a teenager to a parent or guardian plan. There are instances where it may make sense for a teenager to have their own policy. Progressive mentions two: You have a deluxe cars. cars. On a single strategy, all motorists, including the teen, are guaranteed against all cars and trucks.

Vehicle insurance is various for a newbie vehicle insurance coverage purchaser, but it's a blast to start a connection with an insurance supplier. Just how to minimize teen car insurance coverage? Teenagers pay even more for vehicle insurance coverage than grown-up vehicle drivers because insurance policy providers consider them high-risk. There are ways teen drivers can save on their car insurance coverage premiums.

Indicators on Aa - Tá Na Mesa You Should Know

Evaluate versus the truth that young drivers are extra likely to obtain right into accidents. You can also go down detailed and crash coverage if the auto isn't financed and not worth a lot.

You should likewise recognize the insurance firm still charge higher rates for the very first few years of the license - insured car. An additional way to lessen your insurance coverage costs is to obtain yourself of the price cuts available. Several of them are discussed listed below, Discounts for teenager chauffeurs, We've recognized the most effective price cuts for teenager vehicle drivers to obtain affordable vehicle insurance.

That's $361 generally. You can take additional motorist education or a protective driving program. This indicates go above and past the minimal state-mandated drivers' education as well as training (insurance company). In some states, discounts can run from 10% to 15% for taking a state-approved vehicle driver renovation course. On the internet courses are car insurance a practical alternative but consult your provider first to make sure it will lead to a price cut.

vehicle insurance liability cheap car insurance prices

vehicle insurance liability cheap car insurance prices

You could get a price cut around 5% to 10% of the trainee's premium, yet some insurance providers promote up the 30% off. The typical student away at school discount rate is even more than 14%, which is a savings of $404. Maintain a clean record as well as you can receive a discount rate. This means you do not enter into any accidents or offenses.

Several automobile insurer supply discount rates if you allow a telematics device to be placed in your automobile so they can check your driving routines. This is taken into consideration "pay-as-you-drive." This can surrender to a 45% discount rate. With pay-per-mile, you'll pay for the range you drive, instead of driving patterns.

There is possible to conserve. If the student intends to leave a cars and truck at house and also the university is greater than 100 miles away, the university pupil can get approved for a "resident student" price cut or a pupil "away" discount, as mentioned above - affordable auto insurance. These price cuts can reach as high as 30%.

Examine This Report about How Much Is Car Insurance For A 20 Year Old? - Quora

Both discount rates will require you to call your insurance coverage supplier so they can start to use the discounts. Learner's permit insurance, You can get insurance coverage with a license, however many vehicle insurance policy business consist of the permitted teenager on the moms and dads' policy without any kind of action - affordable car insurance.

When that time comes, be certain to check out the remainder of this article for support on choices and discount rates. It may be wise to contact your insurance coverage company for all choices offered to you. Go with no insurance coverage cost savings option, It's possible to inform your insurance provider not to cover your teen, yet it's not a given (cheapest).